- #How to calculate gst in excel how to#

- #How to calculate gst in excel manual#

- #How to calculate gst in excel Pc#

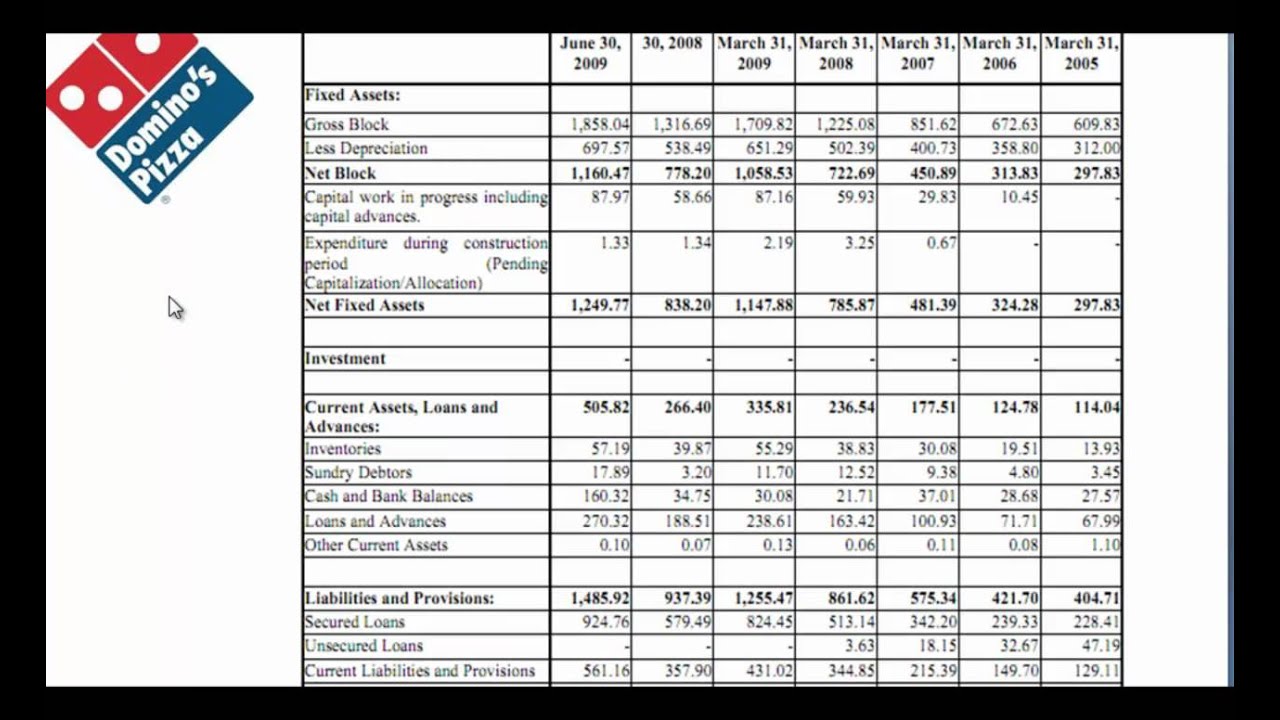

The tax is included in the final price and paid by consumers at point of sale and passed to the government by the seller. The goods and services tax (GST) is a tax on goods and services sold domestically for consumption. Maximum Retail Price Calculation Formula= Manufacturing Cost + Packaging/presentation Cost + Profit Margin + CnF margin + Stockist Margin + Retailer Margin + GST + Transportation + Marketing/advertisement expenses + other expenses etc.

Click the middle Safari button (the box with the arrow) and then ‘Add to Home Screen’. On iPhones: Open Safari and navigate to the GST calculator page. Add the GST calculator as an app on your phone An example of an invoice where withholding tax (WHT) is deducted from the total. (If GST Registered) 400 multiplied by 20 WHT equals 80.00. WHT on Gross Value WHT on Gross Value 400 multiplied by 15 GST equals 60.00. Then you can choose whether you want to save it into a folder or onto your bookmarks bar, and what you want the bookmark to be named.Ģ. Step 2: Calculate the Goods and Services Tax (GST).

#How to calculate gst in excel Pc#

To add the calculator as a bookmark, make sure you’re on the GST calculator page, then press Ctrl+D if you’re on a PC or Cmd+D if you’re on a Mac.

#How to calculate gst in excel how to#

If you use the calculator a lot on your computer, you may want to add it as a bookmark on your browser so you can get to it with just one click. How to calculate 15 GST manually It is very easy to calculate GST at 15 rate: just multiple your GST exclusive amount by 0.15.

Add the GST calculator as a bookmark in your browser How to make the GST calculator easily accessibleīecause our GST calculator is freely available on the internet, you can access it easily from your computer and other devices.ġ.

#How to calculate gst in excel manual#

That’s a lot of manual work for small-business owners to do every time they want o calculate GST-use our calculator instead. To calculate how much the price was before GST, just divide by 1.1. To calculate how much GST is included in a price, just divide by 11.

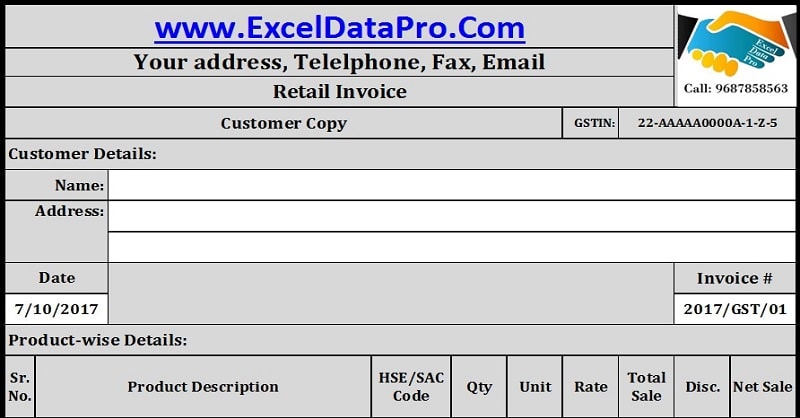

To calculate a total price, that includes GST, just multiply the amount by 1.1. To calculate how much GST to add, just multiply the amount by 0.1. If you have a price that does include GST and you want to find out what the price would be without GST, enter the price in the first field, click ‘Subtract GST’, and you’ll find the original price in the ‘Price’ field and the amount of GST in the ‘GST’ field.īecause GST is 10% of the sale price, the calculator adds 10% of the price to add GST, or subtracts 10% if your price already includes GST and you want to find out the original price. T he calculator will do the maths for you and show you the price with GST in the ‘Price’ field (and the GST that the price contains in the ‘GST’ field). If you have a price that doesn’t include GST but you need it to, just add that price into the first field and click the ‘Add GST’ button. That’s why we created our new GST calculator-because we want to help small-business owners who need an easy-to-use, no-fuss tool that helps them to calculate GST quickly. Sometimes calculating GST as a small-business owner can be tricky and besides, you have so many other things on your plate that you don’t want to spend your time and brainpower on little maths sums like adding and subtracting GST.

0 kommentar(er)

0 kommentar(er)